SILICOM (SILC)·Q4 2025 Earnings Summary

Silicom Stock Surges 19% as Q4 Beats, AI Inference Opportunity Takes Shape

January 29, 2026 · by Fintool AI Agent

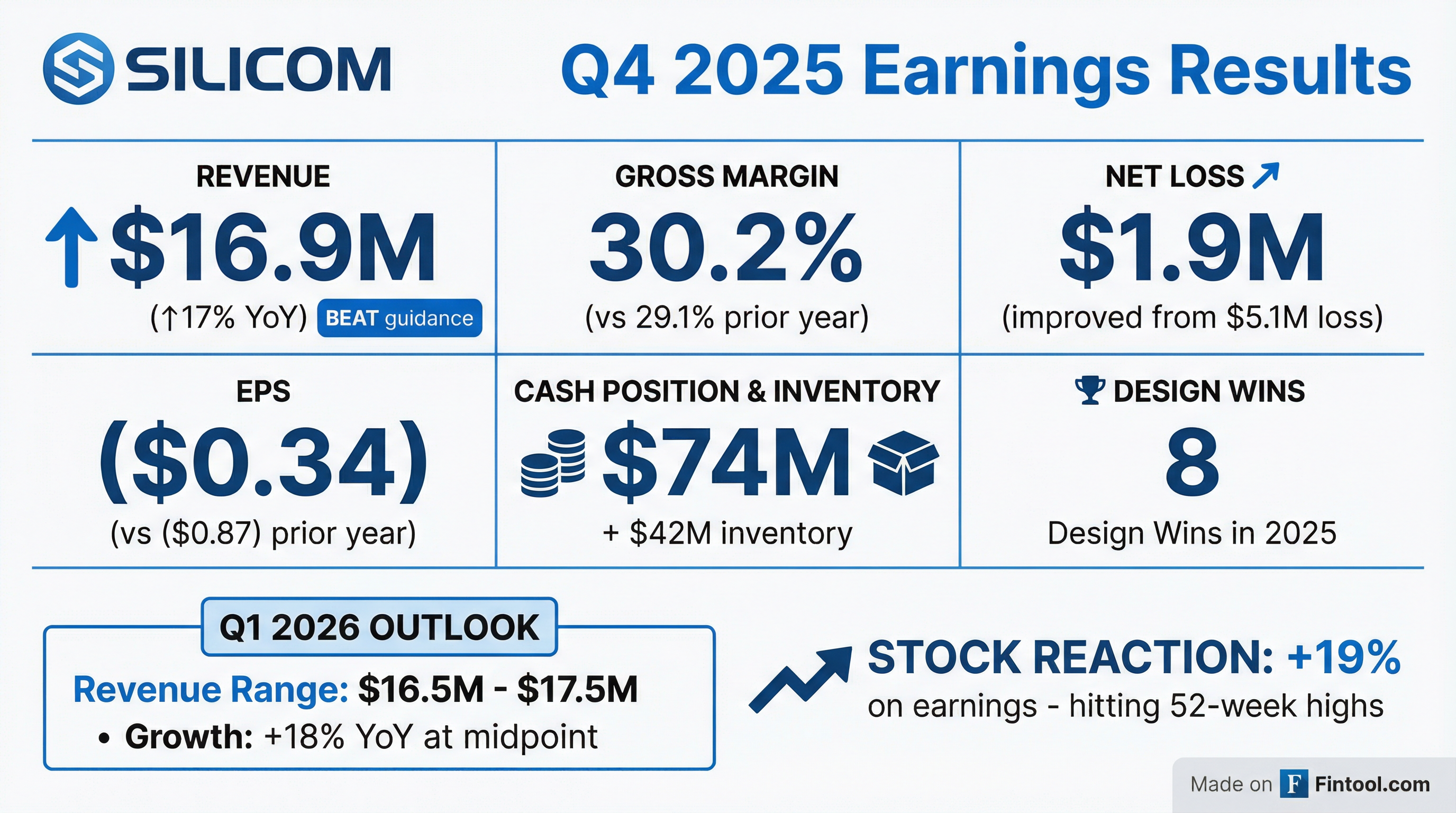

Silicom (NASDAQ: SILC) delivered Q4 2025 results that exceeded expectations on all fronts, sending shares up 19% to near 52-week highs. Revenue of $16.9 million beat the company's own guidance of $15-16 million, while losses narrowed significantly year-over-year.

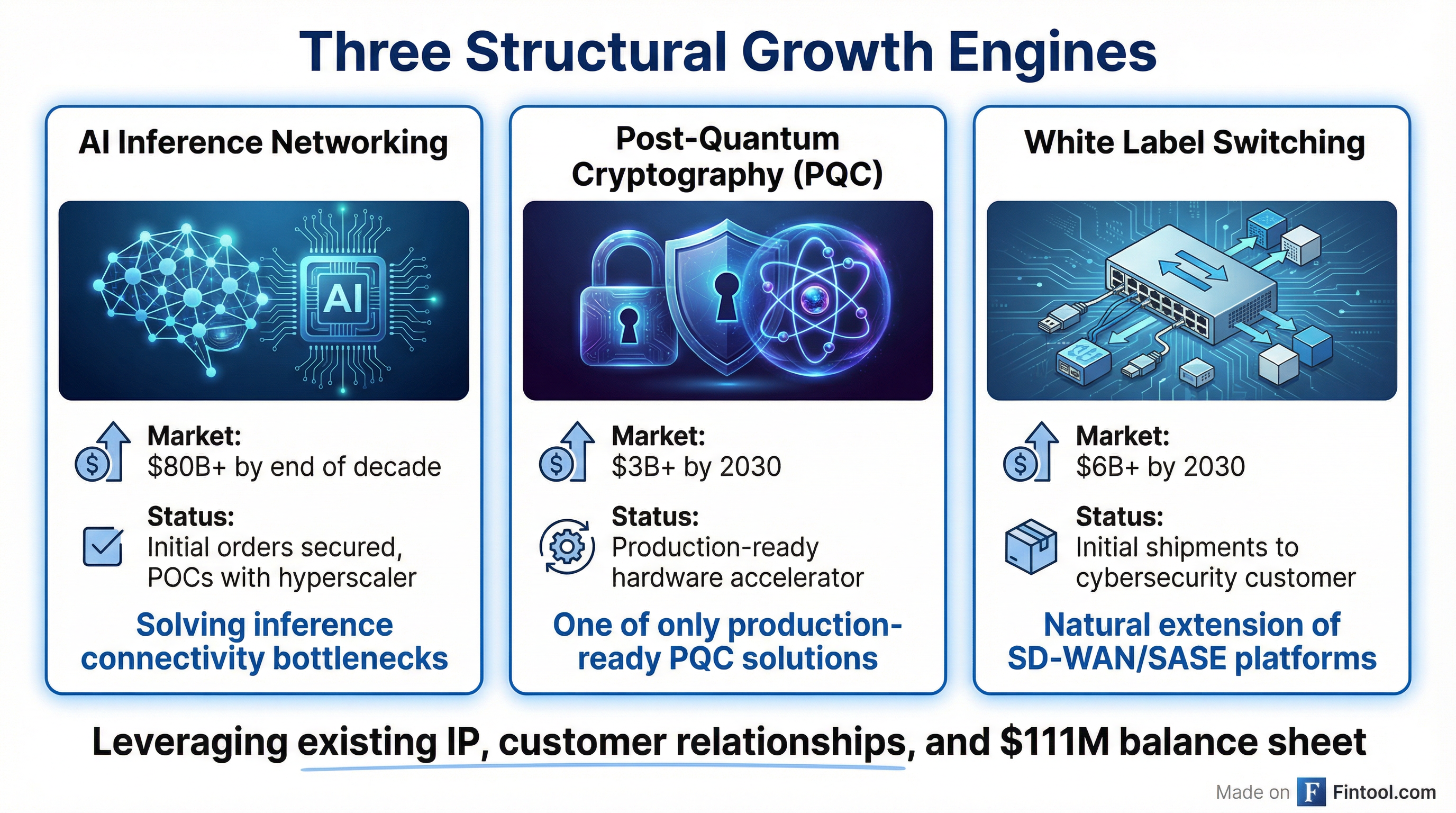

More importantly for investors, management articulated three "venture-style" growth opportunities—AI inference networking, post-quantum cryptography, and white label switching—that could transform the company's growth trajectory while leveraging its $111 million fortress balance sheet.

Did Silicom Beat Earnings?

Yes, convincingly. Q4 2025 results exceeded both internal guidance and year-ago figures:

Revenue of $16.9 million came in "well ahead" of the company's guidance range of $15-16 million, representing a beat of at least 5.6%.

CEO Liron Eizenman attributed the beat to "the success of the strategic initiatives we undertook in earlier quarters, the progress we have made executing through 2025, and the resulting positive impact across our business."

What Did Management Guide?

Silicom guided Q1 2026 revenue of $16.5-17.5 million, representing 18% year-over-year growth at the midpoint.

This is notably 8.6% above analyst consensus of $15.65 million*, signaling management's confidence in continued momentum.

*Values retrieved from S&P Global

Management also reiterated expectations for "accelerated double-digit revenue growth in 2026 and beyond," backed by the eight major design wins secured in 2025 and a target of 7-9 additional design wins in 2026.

What Changed From Last Quarter?

Several key developments mark an inflection point:

1. Design Win Expansion with Major Customer

A global networking and security-as-a-service leader "significantly expanded its deployment of Silicom Edge devices into multiple additional use cases," increasing expected annual revenues from this customer from $3-4 million to $8-10 million—more than doubled.

2. Three "Venture-Style" Growth Opportunities Emerge

Management outlined three major structural market shifts that leverage Silicom's core expertise:

AI Inference Networking — The Largest Opportunity

CEO Eizenman stated: "AI infrastructure investments are shifting from training models to querying the models at scale known as inference. Inference is continuous, distributed, and extremely latency-sensitive... This creates massive networking and interconnect bottlenecks, and that's exactly the problem that Silicom excels in solving."

Current traction:

- Initial orders for inference-optimized FPGA-based solutions for POCs with hyperscaler end users

- Developing a dedicated AI NIC based on a leading high-performance networking chip for an AI inference leader

- In advanced discussions with additional AI inference chip vendors

Management cited an addressable market approaching $80 billion+ by decade end.

Post-Quantum Cryptography (PQC)

Silicom offers "one of the only production-ready hardware-based PQC accelerator solutions available today," implementing quantum-safe encryption algorithms.

Two leading customers have already selected the solution for early deployments. Market expected to grow to $3 billion+ by 2030.

White Label Switching

Expanding from SD-WAN and SASE platforms into white label switches, Silicom has shipped initial quantities to a leading cybersecurity customer. Market expected to reach $6 billion+ by 2030.

3. Revenue Timeline Expectations

Asked about timing, Eizenman noted: "All three opportunities, all of them, I would say, are in the initial stages right now... Even for 2026 as a whole, I think we are not expecting them to be still huge. There is an opportunity for that, but we definitely are expecting our core business to be very, very strong in 2026."

However, he emphasized development speed: "For some of those opportunities, it's actually taking some of our existing products, making some changes on them so we can react very, very fast, and it can actually be a quick road to revenue here."

How Did the Stock React?

Silicom shares surged approximately 19% on the earnings release, reaching an intraday high of $18.88—near 52-week highs of $19.36.

The magnitude of the move reflects several factors:

- Revenue beat above guidance range

- Q1 guidance significantly above consensus

- Tangible progress on AI inference opportunity

- Improved profitability trajectory

Balance Sheet Remains a Fortress

Silicom ended 2025 with one of the strongest balance sheets in small-cap tech:

With a market cap of approximately $102 million, nearly all of Silicom's enterprise value is backed by cash and liquid assets. This provides "the flexibility to not only execute on our ongoing strategy but also allow us to invest and capitalize on market opportunities."

Geographic Revenue Mix

Full-year 2025 revenue breakdown:

One customer accounted for approximately 14% of 2025 revenues.

Q&A Highlights

On AI inference opportunity specifics:

"The inference happens everywhere. And when we say everywhere, it could be at the edge of the network, it could be a local data center, it could be a telco data center, it could be even in the enterprise. And there are so many different installation types and deployment types and types of different networking they need to support... So if you want to do scale out to multiple servers, multiple ports, how do you do it efficiently? How are you making sure that the network is not a bottleneck and that you actually get the most that you can out of the inference chip? That, I think, is the key."

On R&D investment needs:

"Right now, we don't think that we need [additional R&D spending] because, as I said, we are really building on the IP and the know-how and the team that we have that is running for so many years together, and it's an expert team. If we will need, obviously, we have the fortress here in terms of cash... In any case, we don't expect it to be significant."

On sales team structure:

"We think we have the right team and the right size of the team and the right know-how and expertise... The entire team is really well-structured to support this growth. And the existing relationship that we have with customers that we're building on and capitalizing on, we expect to continue with that."

Key Risks and Considerations

- Customer concentration: Top customer at 14% of revenue; expansion customer moving from $3-4M to $8-10M increases concentration

- New opportunity timing: Management explicitly stated AI/PQC/switching opportunities are "in initial stages" with minimal 2026 revenue contribution expected

- Currency headwinds: Operating expenses were higher than expected due to USD weakness versus Israeli shekel and Danish krone

- Continued losses: While improving, Silicom remains unprofitable at the operating level

Forward Catalysts

- Q1 2026 earnings — Execution against elevated guidance ($16.5-17.5M)

- Design win announcements — Targeting 7-9 wins in 2026; any AI inference wins would be significant

- AI inference POC conversions — Movement from POCs to production orders with hyperscaler

- Customer expansion — Ramping of $8-10M annual customer relationship

- Post-quantum cryptography adoption — Government/enterprise mandates could accelerate

The Bottom Line

Silicom delivered a beat-and-raise quarter that validates its turnaround execution, but the bigger story is the articulation of three substantial growth opportunities that leverage existing IP and customer relationships. With $111 million in liquid assets (nearly equal to market cap), zero debt, and tangible early traction in AI inference networking, Silicom offers a rare combination of downside protection and optionality on secular growth themes.

The key question: Can management convert initial orders and POCs in AI inference, PQC, and white label switching into meaningful revenue streams? The 2026 guidance suggests core business momentum continues regardless, while the new opportunities represent potential upside catalysts.